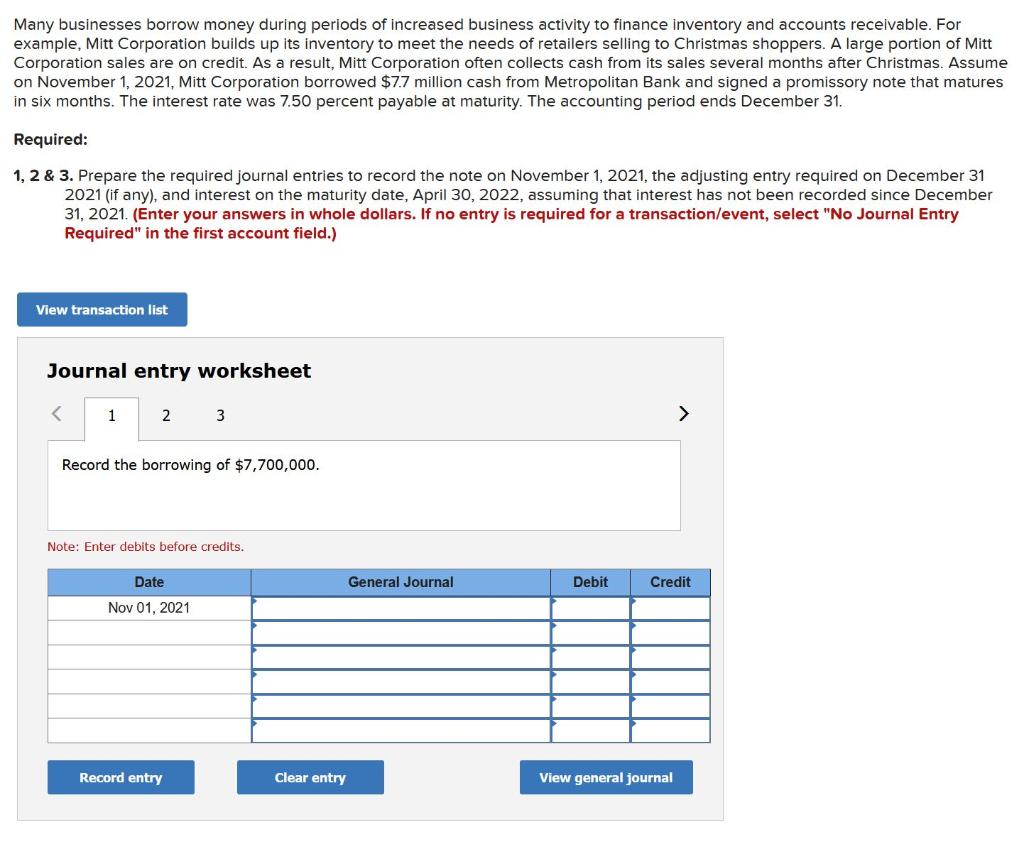

That is what we should understand the latest Va financing, that is a method, a network, an advantage and you may a means to score home financing for folks who was a veteran or an active obligations service affiliate inside a beneficial part of your army. The only thing your Virtual assistant mortgage is not , is actually that loan. That’s certainly the confusing issues, so there try other people. How come experts and you can effective obligation people try keen on the fresh new Va financing is basically because it includes a summary of positives one, once you range them upwards, is virtually unbelievable. Not one program on the authorities arrives near the Virtual assistant financing be certain that when it comes to professionals, costs discounts and extent. You can imagine it is simply an effective way to get an effective reduced mortgage, however it is more than one to, and you will here’s what you need to know.

What’s the Va Loan?

The latest Virtual assistant mortgage is actually that loan ensure. It is fundamentally a binding agreement from the Service of Veterans Activities and also the federal government to face about almost any mortgage you get because you are a former or most recent member of the newest military. That isn’t the mortgage alone – which comes away from a private bank or mortgage broker but alternatively a type of insurance. They tells the loan bank you are an effective exposure and that government entities are guaranteeing your loan should you cannot pay it off. It is, in reality, a kind of financial insurance policies.

That it reduced amount of exposure, towards the financial, enables you to a more attractive financial applicant also it is let you house home financing. This will be especially important to have first-time homebuyers who are offering, or with served, throughout the military.

What are Virtual assistant Loan Masters?

The menu of great things about the brand new military Virtual assistant loan ensure was a lot of time…longer. The big Around three professionals, with regards to discount, are:

- Zero down money

- Zero private mortgage insurance

- Down rates

There are more experts, however these three could save you thousands of dollars at the start following continue steadily to help you save tens of thousands of bucks along the lifetime of your Va financial. Other people include:

- Existence gurus, meaning you need the Virtual assistant financing work for many times while in the your lifetime

- The Va mortgage work for can be used for solitary-friends home (as much as four devices), apartments, are produced land and you will the fresh new builds.

- The fresh Virtual assistant loan make sure limits your settlement costs

If you want to know-all the great benefits of the Va financing guarantee, it is better to investigate the complete number. You will notice why we telephone call you could try these out the fresh new Virtual assistant system the fresh new Silver Basic.

Local Western Direct Financing

The newest Va system keeps other financing that we tend to mention then below. The brand new Indigenous American Direct mortgage is designed to help Local American military group see otherwise build a property. If you’re an experienced otherwise active duty solution member, and either you otherwise your lady was Local American, you may be entitled to new NADL. These types of funds assist armed forces experts and you may energetic-responsibility service members pick, build or increase a home towards the government faith home. If you meet the requirements, you may also use this financing so you’re able to refinance your existing financial. This one are an authentic loan on authorities and not a guarantee.

The newest Virtual assistant Loan Compared to the Almost every other Finance

When comparing the fresh Virtual assistant mortgage ensure for other federal home loan loan apps (or even old-fashioned fund), they usually happens ahead. I’ve revealed you the complete selection of positives (above), but it is advisable that you be familiar with all your valuable possibilities if you find yourself looking an alternative house and you may looking to land a home loan.

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/logo-chuan.jpg)

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/thu-mua-phe-lieu.jpg)