A great pre-foreclosures happen whenever a homeowner non-payments to their loan money, getting their house in jeopardy out-of foreclosure. Alternatively, the fresh borrower decides to pay-off brand new a good equilibrium or promote the house through that day. Pre-property foreclosure residential property is popular certainly one of a residential property investors for 2 aim. A person is there is no advertisement for Pre-property foreclosure residential property. So discover minimal competition. Secondly, pre-foreclosure are excellent a house assets, mainly because property normally number on the market under market value. Extremely domestic people trying purchase pre-foreclosure, additionally, was not knowing from ideas on how to buy a pre-foreclosure.

If you’re considering to order a home and would like to search on the internet in order to see selection, you reached the right spot. Sometimes you find a house marked once the a great pre-foreclosure when you’re starting to be aware of the town – visually examining properties that appear to meet up your preferences and you can matches your current budget, dare feeling excited about the candidates.

Understand the concept of pre-foreclosure residential property

Given that declaration means, our home inside concern is into brink away from foreclosure. The new tenant has fallen outstanding on their financing payments. As they continue to have a way to carry on before the bank confiscates our house. He’s indeed obtained a formal standard notification. Pre-foreclosure ‘s the early stage throughout the property foreclosure procedures. Although not, they differs from place to put. This new judge process generally speaking initiate when a debtor misses three consecutive month-to-month costs. The lending company will then send out an excellent pre-foreclosure statement. It suggests that our home is about to foreclose instantaneously. The new homeowner will have up to dos-ninety days to reply just after acquiring the brand new observe away from standard in a just be sure to avoid the property foreclosure continuing. In contrast, instead of foreclosures, the master can also be liquidate the house or property capital by themselves. They listing a home on the market on a less expensive rate owed towards seller’s immense motivation.

Identifying leads directly in pre-foreclosure homes

When selecting good pre-bankruptcy proceeding, recognizing how of course discover pre-property foreclosure leads is essential. Choosing a specialist a home representative ‘s the most readily useful approach for determining pre-foreclosed belongings or a great pre-property foreclosure bidding loans Bonanza. Registered brokers keeps accessibility to the numerous Assets Attributes, which has information to have pre-property foreclosure belongings. This type of consultants can usually make up for new profits of one’s package. You may to get regarding-markets residential property via local in public places offered pointers, hit, real estate agent dealers’ information, otherwise local lawyers’ recommendations.

A property from inside the pre-foreclosures and you may a short product sales lot may have particular similarities upon earliest browse, but they are notably collection of. A primary revenue is when a borrower owes far more on the their residence than just cherished. It can be classified because the underwater.’ Small selling houses involve negotiations for the mortgage lender so you can record property available from the lower than any type of can also be own so you can avoid that it shortfall. The master usually can leave ever since off cancellation with no other liabilities. When you’re property and apartments in pre-foreclosure typically score sufficient well worth so you can cover this new the financial.

Research a collector

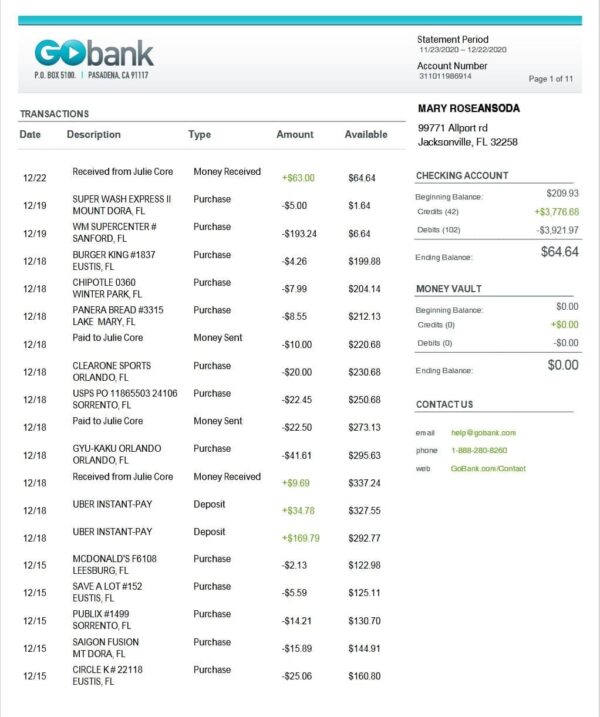

You may want to wanted an effective pre-acceptance document off a creditor when selecting a property through an excellent pre-foreclosure home. So it document commonly imply exactly how much you could provide. You can now concentrate on assets financial investments which might be below your price range. Good pre-recognition report and additionally indicates that youre a simple yet effective and you may legitimate buyer for the citizen. But not, most brokers will will not assist you if not get this statement. You can see a study out-of pre-recognition. Needed the second files to discover the recognition page:

- Your account statements

- Paystubs regarding the last couple of weeks

- Report about credit

- Statistics out-of tax statements

- Your title proof like your passport or a creating licenses

Distribution a proposition:

You are able to an offer should you get an excellent pre-acceptance statement on your own need pre-foreclosure home. This new settlement stage on family needs 1-8 weeks. If you are writing on a difficult mortgage borrower or bringing financing, now frame can be considerably faster. It is best to hire a genuine property representative whenever you are putting in a bid. As they are always aware of the fresh measures, the representative often represent you for the dealings if you are talking about the brand new citizen otherwise creditor. Then you can transmit product sales agreement to your financial to help you initiate assessing the borrowed funds in case your proprietor gets your offer.

Settlement is the last phase in the pre-foreclosures pick processes. Payment is the last stage of purchasing a pre-closing property. Inside stage, the newest identity toward possessions can also be convert to the brand new thriving proprietor’s term. This new import procedure usually takes couple of hours. The fresh closure Price happens in a concept corporation. Off repayments, and additionally loan costs, responsibility insurance policies, animated income tax, and you may home taxes, try upcoming due. These costs can also be estimate 2% to 5% of your own to buy rate. Brand new money asset is all yours if the closing phase for the to order a great pre-foreclosures normally complete.

In the long run, after you choose every stages in to order a good pre-property foreclosure domestic for sale. Then make sure the fresh new expenses will change for the control. Get in touch with a locksmith and then have the fresh hair for everybody of one’s gates in your home. Replacing dated locks allows you to avoid any possible accident. When your possessions requires renovation, reach works upright instantly. Record our house obtainable otherwise lease when it is inside decent profile. Pledge this informative guide will allow you to inside the to purchase a foreclosures house effortlessly.

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/logo-chuan.jpg)

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/thu-mua-phe-lieu.jpg)