This blog explores just how mortgage lenders is also defeat world demands as a result of digital conversion. Centering on the key benefits of automation, analysis analytics, conversational AI, and APIs, it highlights just how these types of development can enhance abilities, increase consumer experience, and push profits. Anaptyss’ Electronic Knowledge Surgery framework even offers designed remedies for optimize mortgage financing techniques and you will improve service birth.

Now mortgage brokers deal with unmatched demands inside fast-moving and you will competitive range functions, improve will cost you, and offer a seamless user experience happens to be a whole lot more extremely important than ever. According to McKinsey, digital conversion practices and you can enhanced customers sense lead to in the 20-30% customer care and up to 50% payouts.

step 1. Maximize abilities that have automation

Financial institutions and you can lending institutions find automation while the a word having deals, i.age., rescuing go out, money, and effort. They truly are looking at reduced-code with no-code choices, plus Robotic Procedure Automation (RPA) and you may AI-powered document extraction. With automation tools, home loan credit companies is also improve their work-intense procedure, keep costs down, enhance the team’s overall efficiency, and you will quickly measure which have consult.

Regarding digital boarding, file management, and you will underwriting in order to calculating actual-day financial https://paydayloancolorado.net/ordway/ cost solutions, fulfilling globe conditions, and you may becoming agreeable, smart automation alternatives can also be help the complete home loan origination procedure.

dos. Make advised choices with research analytics

The loan credit industry needs to manage large volumes off studies each day, which eats immense perseverance. Cutting-edge analytics selection centered on predictive studies process, host studying formulas, and you will business procedure automation allow perfect investigation from buyers guidance, greet risks, to make informed behavior. Listed below are some ways cutting-edge analytics provides revolutionized the new old-fashioned home loan credit process:

- Familiarize yourself with analysis to help you recruit an educated recruiting

- Improve to generate leads and you can management

- Live track of loans all over products and channels

- Point high-measure pre-approvals and you will instant mortgage conclusion

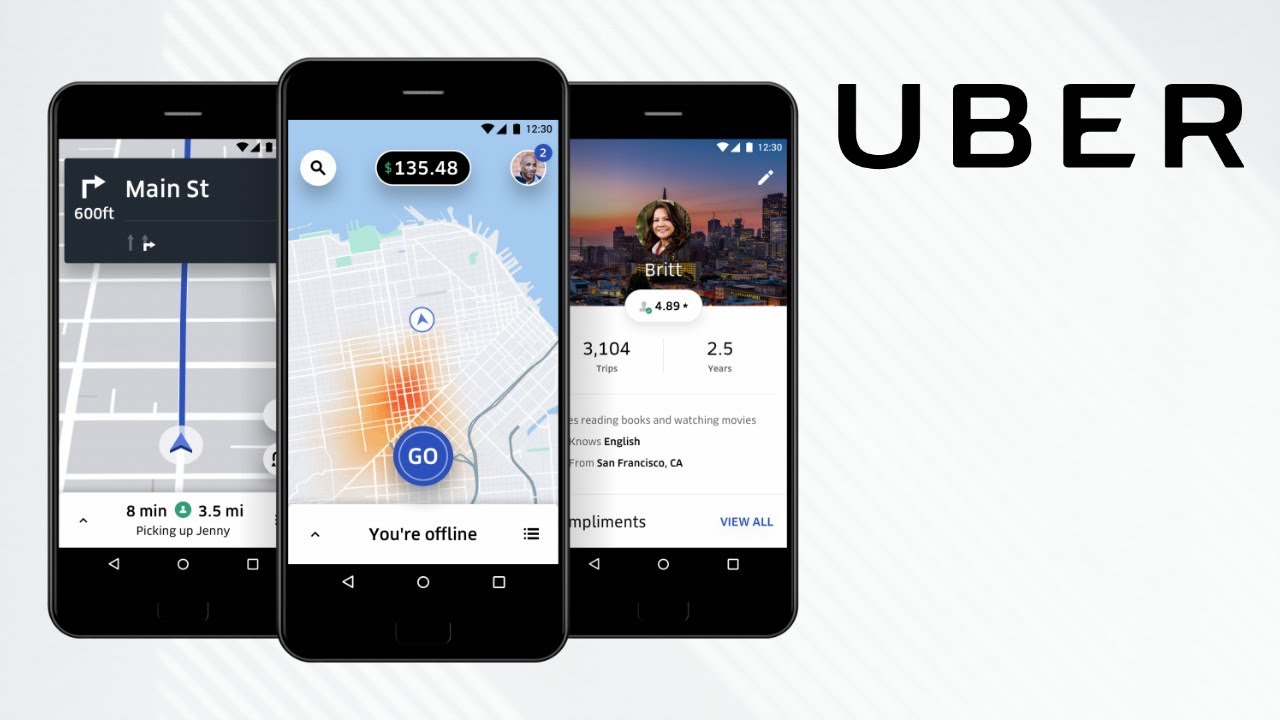

step 3. Augment consumer experience with Conversational AI

Applying AI, ML, and NLP is the the fresh new trend regarding the home loan financing industry. To increase an individual experience, opportunities was getting it’s phygital’ financing knowledge. Regarding chatbots, digital personnel, and you may wise dashboards, to receptive UX and you can contactless money, credit institutions is aggressively committing to advanced innovation to deliver super-personalized customer support from the moment the fresh new homebuyer countries towards website. Some benefits associated with advanced entertaining tech try:

-

- Round-the-time clock functions

- Human-such telecommunications

- Accelerated impulse date

- Customized sense

- Increased prospecting selection

cuatro. Accelerate mortgage expertise in APIs

Mortgage brokers try implementing home loan application playing with software coding connects or APIs to improve show and supply complete functions across the environment out-of borrowers, authorities, and partners.

Even though many financial credit people be unable to manage margins due to costs, low-rates of interest and emerging race, APIs change the borrowed funds strategy to raise returns and you may total return. Check out benefits associated with APIs:

Implementing Digital Solutions to own Real estate loan Origination

Mortgage lending is heavily investigation-driven, out of starting and underwriting to create disbursal and you may servicing. Its essential to possess lenders to help you benefit from electronic choice to help you improve its measures and you will abilities.

That have intelligent digital possibilities, mortgage brokers is improve the loan procedure and you will meet compliance that have this new ever before-changing guidelines, send services from inside the a shorter time, and maintain powerful solutions getting consumer research safeguards.

New Electronic Education Surgery (DKO) build is actually a personalized provider method that assists lenders and you will almost every other monetary services changes the company and you may technology functions inside a customized and value-productive trend.

Eg, the new DKO means aided an excellent Us-dependent lending company re-professional the business methods to allow nimble service delivery. In addition helped the business embrace optimal electronic solutions, including the RPA equipment and Wise dashboard, enabling approx. 15% change in the closure cycle some time and 20% overall performance improve. Peruse this example to get more info.

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/logo-chuan.jpg)

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/thu-mua-phe-lieu.jpg)