Essentially, you don’t want to pull out people the newest debt while you’re in the process of closure a mortgage loan. Very, whenever Do you really Get a consumer loan Immediately following To purchase a property?

And, once you’ve signed on that loan, you probably want to hold off three to six months before you take away a personal loan. Personal loans can be handy to possess home owners, and there’s zero official laws that you can’t get you to definitely when you’re wanting a home.

- Your credit score takes a bump and apply to the loan pricing

- Your debt-to-income proportion will get raise and you will connect with the home loan qualification

- If you’re currently working with a home loan company, they are notified on mortgage craft

- You can also impression your own mortgage loan qualification even in the event you become eliminated to close off

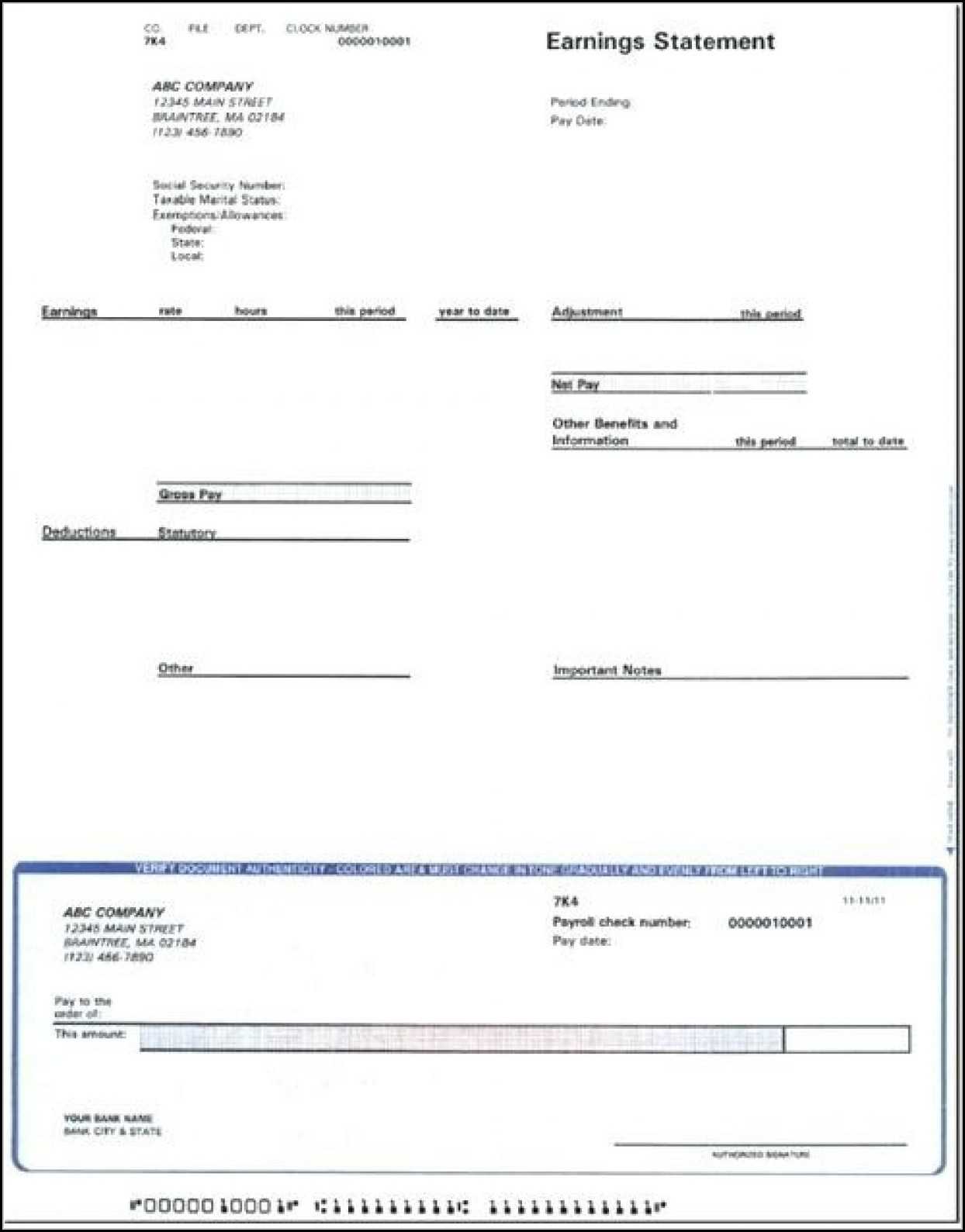

If you’re nevertheless not knowing from whether or not you really need to sign up for an excellent personal loan when selecting a property, here’s an enthusiastic infographic that can help you understand:

If you get a personal bank loan When purchasing property? Do’s and Don’ts

- Try and sign up for a personal bank loan to pay for brand new down-payment.

- Plan to obtain to pay for settlement costs, monitors, moving will set you back, an such like. with an unsecured loan.

- Pull out financing whatsoever if you are planning to put on to have home financing soon, as a whole.

- You will need to hide unsecured loan passion away from loan providers.

- Fool around with a personal bank loan getting expenditures like chairs, fixes, home improvements, and you loan places Hoehne will low-home loan expenditures better after you’ve currently paid on the new home.

Expenses associated straight to brand new selling-eg appraisals, checks, and you may down costs-would be best taken care of that have bucks otherwise off currency borrowed in person regarding the lending company.

Remember that which applies to more than simply signature loans. Actually borrowing from the bank from friends can occasionally have unanticipated outcomes. Since the commonly, home loan gurus remark debt hobby observe the length of time you’ve got your bank account. Any abrupt higher expands might have to become explained to the newest prospective mortgagor, that may hurt your chances so you’re able to qualify for a home loan.

Assist! I purchased a home now I am House Poor

In case the mortgage payments is taking on significantly more compared to suggested 25% of one’s grab-household shell out, you could be economically restricted, aka family terrible.

This really is a tricky disease to manage. Here are some details when you find yourself against a property-relevant economic crisis:

When in Question, Pose a question to your Home loan Administrator

Unsecured loans can come from inside the handy for property owners trying improvements otherwise solutions. However they will likely be problematic to use close to house-to find time.

Whatever the case, you can ask the fresh new agent you are coping with if the providing away a personal bank loan can be helpful. Each mortgagor is different and more than want to make it easier to have a profitable homebuying experience, therefore it is basically best for rely on their recommendations.

The information in this article is actually for standard educational purposes merely. Republic Finance doesn’t make any guarantees or representations of any form, display otherwise required, depending on the suggestions offered within blog post, like the reliability, completeness, fitness, flexibility, supply, adequacy, or precision of one’s information in this article. Everything contains here isnt meant to be and does perhaps not form monetary, judge, taxation or other guidance. Republic Fund does not have any responsibility for all the mistakes, omissions, otherwise inaccuracies in the guidance or people responsibility as a result of people dependence apply such as suggestions from you otherwise anybody who could possibly get be informed of the guidance in this post. One reliance you put on suggestions contained in this post is precisely at your very own exposure. Republic Fund will get reference third parties within this article. A third-class resource doesn’t constitute sponsorship, association, relationship, or endorsement of the alternative party. People third-group trademarks referenced is the possessions of the respective residents. Your own fool around with and entry to this web site, webpages, and you can one Republic Fund web site or cellular software is at the mercy of our Terms of use, available right here.

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/logo-chuan.jpg)

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/thu-mua-phe-lieu.jpg)