Acquiring financing purchasing raw land (in the place of homes that have a home and other property already with it) are going to be tough. Even if you will get a loan provider prepared to money the brand new pick, the rate and costs could be rather more than on a normal home loan. One to choice, for folks who very own a home who’s got collected some collateral, should be to take out property equity loan. However, this has some serious dangers. This is what you need to know.

Trick Takeaways

- You are able to the latest arises from a house equity financing to own whatever you need, along with buying home.

- Although not, if you’re unable to improve money on your own home security loan, you can clean out your home.

- Undeveloped property doesn’t constantly rise in really worth, this are going to be a risky capital.

- Playing with property equity loan to get homes next to your family you can expect to increase your residence’s worthy of full.

Property collateral financing makes you faucet the fresh new security you’ve produced in your property, typically during the a relatively low interest. The chance is the fact due to the fact mortgage spends your house because the guarantee, you might reduce they if you’re unable to retain the payments.

In order to be eligible for a house security loan to invest in land (or for virtually any purpose) just be sure to have a good obligations-to-earnings ratio, a good credit score, proof earnings sufficient to pay back the loan, and at least ten%, 15%, otherwise 20% security of your house, with respect to the bank.

You could determine this new collateral of your house by deducting the newest number you will still are obligated to pay involved from its newest estimated worth. Such as for example, in case your household you certainly will bring in $five-hundred,000 now along with $200,000 during the financial loans, your own security was $300,000. To change you to definitely into the percentage terms, divide the equity of the current property value your house. In cases like this, $300,100000 separated by the $500,one hundred thousand is 0.6, or 60%-ample so you’re able to be eligible for a house guarantee loan.

Lenders usually would not enable you to borrow one hundred% of the equity, yet not. For the a familiar condition, the utmost could be 80% of house’s value, minus the financial personal debt. So, from the analogy a lot more than, the newest citizen might be able to use to $two hundred,100 ($five hundred,100000 times 80% translates to $eight hundred,100. $eight hundred,one hundred thousand without $two hundred,000 translates to $2 hundred,000).

After you’ve eligible to a house security loan and you may received new loan’s continues, you might spend currency although not you want. If you’re to order home, it’s a good idea not to ever invest it all for the possessions however, to save adequate profit reserve to cover property taxes, maintenance can cost you, and you will any improvements you ought to create. Except if the brand new property try producing earnings in a number of almost every other method, you’ll need to security all of those expenses on your own as well as adds up.

In case it is their intention to create a house yourself towards the brand new belongings, a homes loan might be other solution. A casing financing is a preliminary-identity loan one stops once design is accomplished. At that point, you will find a house that is eligible for a routine financial.

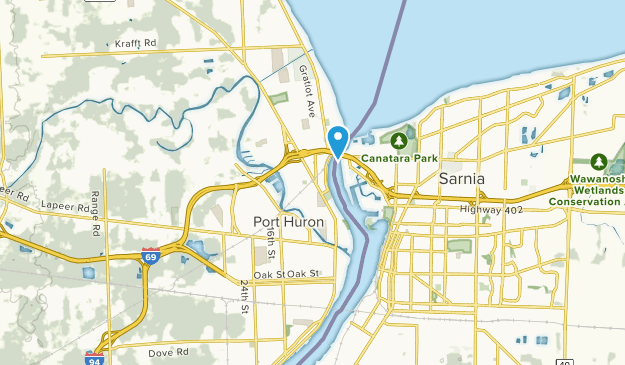

In case your house you happen to be to acquire was adjacent to your possessions, playing with a home security loan is a good financial and fundamental possibilities. Having an extra parcel next to yours will give you even more options accomplish things like dressed in an extension (or yet another dwelling) for your grown students or ageing mothers, or design an outbuilding to have functioning remotely or watching readers. Expanding their parcel size should also raise your residence’s market price when it comes time to market.

As the an extra work for, you might be qualified to receive a taxation deduction to suit your desire repayments, based on just how you spend the money. Once the Taxation Cuts and you can Work Work off 2017 suspended brand new deduction getting notice towards the household guarantee finance and credit lines of 2018 so you’re able to 2026, they generated an exclusion to have funds that are put “to order, build or substantially boost the taxpayer’s family you to secures the loan.”

Zero, you simply cannot get raw (undeveloped) belongings which have a traditional mortgage. Provider financing, a You Agencies off Farming (USDA) financing, otherwise a house collateral financing on property you currently very own are among the many a means to finance a secure get. Expenses cash, if you possibly could assembled they, is another solution.

Are House a good investment?

Proponents from investing in land argue that it is a great capital because individuals are always need somewhere to call home, develop eating, and construct anything. As the saying goes, they’re not and work out anymore of it. But homes is a risky proposition, especially for quick dealers. Possessions taxation, zoning transform, highest advancement will cost you, and repair costs can easily eat on any possible earnings and you may make belongings a financial load into the proprietor.

Do you require a home Equity Loan to purchase an excellent REIT?

If for example the risks of to find, managing, and you can development genuine home are too much to you personally, you could potentially think investing an investment faith (REIT). An excellent REIT basically swimming pools funds from of many dealers to buy and you may perform a diverse portfolio of services. Whilst you could use a property guarantee financing buying on the good REIT, borrowing from the bank facing your residence to shop for some thing are rarely a good notion.

The bottom line

Although you are able to use property equity mortgage to order belongings (or anything), land are a naturally high-risk financial payday online loans support that will never be really worth risking your residence to have. If you proceed, guarantee that you plan on of several will set you back that are included with maintaining and development belongings before you can actually select money with the your investment. In many cases, playing with property security mortgage to enhance your residence’s parcel size might be an effective economic decision, as you are able to enhance your residence’s well worth once you sooner sell.

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/logo-chuan.jpg)

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/thu-mua-phe-lieu.jpg)