Chris is an award-profitable previous publisher with 15 years of experience in the home loan business. A national specialist in the Virtual assistant lending and writer of The book on the Virtual assistant Money, Chris has been searched from the Nyc Times, the fresh new Wall surface Path Journal plus.

The Va handicap score in itself does not have any bad affect Virtual assistant mortgage qualifications. Indeed, your ranking might provide cost-saving pros and additional earnings in terms of a good Va mortgage, even though you features less than perfect credit.

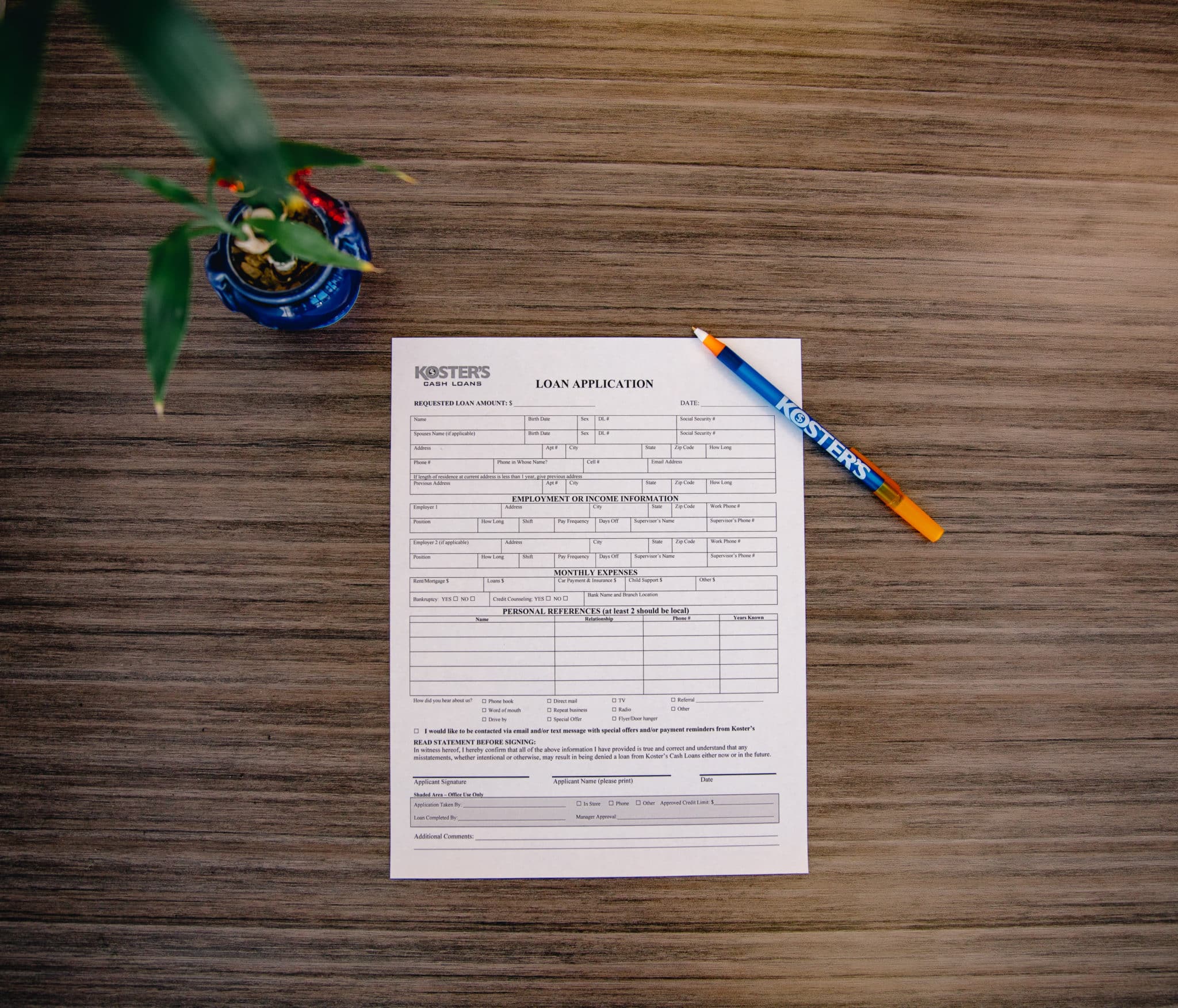

Each month or a couple, I’ll discover this concern or a small type of it: “Should i be eligible for an effective Virtual assistant loan because the a handicapped seasoned that have poor credit?

It is a great trickier concern than it could basic appear therefore we can crack it on to two fold. You to definitely, does an impaired experienced qualify for a good Virtual assistant mortgage? As well as 2, could you be considered that have bad credit?

Manage Handicapped Pros Be eligible for Virtual assistant Loans?

But not, all of the military individuals have numerous standards to hit so you’re able to completely be eligible for a Va mortgage, off appointment the service requirements and you will a good lender’s credit rating minimum so you can continual earnings and you may acceptable financial obligation-to-income ratio.

Nothing concerning your disability score by itself is just about to apply at your chances negatively. In fact, Virtual assistant loan providers is also count disability income as the active income to your an effective home loan, and you will borrowers that have a help-linked disability try exempt from paying the Virtual assistant resource payment, a compulsory cost the newest Va applies to every get and refinance mortgage to help defense loss and make certain the fresh program’s continued achievements.

Va Financing Benefits having Handicapped Pros

A couple most Va financing positives to have disabled Pros, whether or not he is ten percent otherwise 100 per cent disabled, would be the Va money fee exemption and also the capacity to amount handicap income, and this we shall diving towards less than.

Experts receiving compensation to have an assistance-linked handicap try exempt regarding make payment on Virtual assistant investment percentage, that is otherwise applied to most of the buy and you may re-finance finance.

Are exempt out of paying the funding payment is a huge work for. This percentage is a portion of loan, plus it happens right to the brand new Va.

For some very first-go out buyers, the cost try 2.15 percent, and therefore on the a good $250,000 mortgage is $5,375. Individuals instead https://paydayloanalabama.com/mcmullen/ a difference normally query the seller to invest this otherwise shell out it themselves, either upfront or higher date because of the moving they into the financial.

Lenders should get and you will remit the cost to your Va unless there can be obvious papers proving the latest borrower try exempt. However, Pros which found a disability rating once their financing closing might be able to see a refund of their Va investment percentage.

Relying Impairment Money into the a Va Financing

Like any other prospective debtor, handicapped Veterans that are entitled to a great Va financial never have one immediately. They will certainly still have to meet good Va-recognized lender’s borrowing and you will underwriting conditions. Fundamentally, Va lenders want a the very least an effective 620 credit rating to go pass. A constant, legitimate money that is attending continue is essential. Therefore has a healthier harmony between loans and you will income.

Construction Gives to possess Disabled Pros

Disabled Experts s. This will help to Pros adapt or retrofit qualities to meet up with their unique demands. Provides can run up so you’re able to $5,000 and also $ten,000 in some cases. The borrower’s problem varies, therefore it is best to get in touch with the newest Virtual assistant straight to see whether you happen to be eligible to make use of the SAH system.

Property Income tax Exemptions

Individuals exactly who receive handicap money could be qualified to receive property taxation exemptions. These types of exemptions can vary by the condition or any other factors.

During the Pros Joined, it could be possible for consumers to be eligible for that loan that have income tax-exempt amounts and also have escrows create to reflect the brand new difference. Talk with a pros United Virtual assistant Mortgage Pro at 855-259-6455 for lots more details.

Imagine if the newest Veteran try Ranked Incompetent?

In some cases, the brand new Va will get determine one to Experts can’t create the individual tough-attained Virtual assistant positives on account of health-relevant points.

When this happens, the fresh new Virtual assistant usually designate a fiduciary to receive the newest disability compensation that assist the latest Seasoned better put it to use.

Veterans during these factors might possibly proceed with a good Va financing. However these documents require formal approval in the Virtual assistant in check to shut.

Va officials want to make sure the fresh new loan is actually the best appeal of your Experienced. Feedback minutes can differ of these, even so they can take around two weeks within the some cases.

Mortgage brokers having Handicapped Experts having Less than perfect credit

To respond to next a portion of the question, providing an excellent Va mortgage when you are handicapped sufficient reason for poor credit really relies on your concept of bad credit.

The fresh new Va cannot lay a minimum credit score demands, but loan providers generally want to see good 620 mortgage credit history or more so you can secure resource.

However, when you are lower than an effective lender’s credit rating minimum, that will not immediately number you aside. Veterans United offers free of charge borrowing from the bank consulting attributes for those aspiring to be eligible for a good Virtual assistant loan.

Chris Birk ‘s the writer of The ebook towards Va Finance: A significant Help guide to Maximizing Your home Mortgage Advantages. A honor-winning former creator, Chris produces regarding mortgages and you can homebuying getting many internet sites and publications. Their data and you will posts possess looked during the Ny Minutes, the fresh new Wall Street Record, Us Now, ABC News, CBS Information, Military and more. More than 3 hundred,000 individuals go after Virtual assistant Fund Insider, his interactive Va loan community to your Twitter.

Pros Joined is recognized as a leading Va lender on the country, unrivaled inside our expertise and you can experience in Virtual assistant money. Our tight adherence so you can precision as well as the large editorial requirements claims the information is predicated on very carefully vetted, objective researchmitted so you’re able to excellence, you can expect advice to the state’s Veterans, ensuring its homebuying feel is told, seamless and you may covered having stability.

Related Postings

Understanding Va financing entitlement is key to make probably the most from their hard-gained benefit. Right here, we fall apart basic versus. added bonus entitlement and how their entitlement influences your own deposit and restriction amount borrowed.

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/logo-chuan.jpg)

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/thu-mua-phe-lieu.jpg)