Much more about

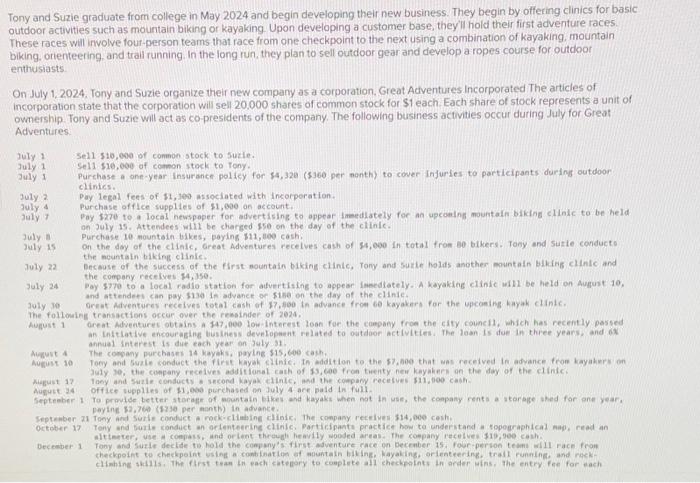

Nearly good century ago, Congress created the Government Financial Bank operating system (FHLBs) to promote home ownership and offer exchangeability to thrifts (discounts and you will finance) and you will insurance companies that primarily offered mortgage loans during the time. The current financial system is actually drastically different: Thrifts is actually just financial institutions; mortgage lending originates from inside and you may beyond the bank operating system; and you will securitization is amongst the driving force to possess exchangeability about casing loans markets. In the light of those endemic alter, it is the right time to reassess the purpose and objective of one’s FHLBs. The regulator, new Government Property Money Agencies (FHFA), enjoys revealed an intensive feedback.

New Brookings Institution’s Focus on Control and you will Markets, Boston University’s Overview of Banking & Economic Laws, and you can Boston School College or university from Laws co-organized a forum to talk about and you will debate how FHLB program are doing work, exactly what the goal will likely be, and just what reforms, if any, might be undertaken. I heard from an array of gurus, in addition to newest FHFA Movie director Sandra Thompson, previous FHLB authorities, affordable homes supporters, and you may best teachers and you will experts. Listed below are five key need aways in the experience, and that is noticed entirely right here.

step 1. Will be Government Financial Financial institutions concerned about its mission to help you provide homes?

Supporting construction funds ‘s the fresh function of brand new FHLB program, monthly installment loans no credit check Arizona but there is no needs one to people play with FHLB improves in order to provide housing. Lisa Rice, chairman and you will President of your own National Fair Houses Alliance, explained the borrowed funds business bodies challenging institutionalized preference toward light People in america, listing one to mortgages were not made universally offered to anybody… [these types of policies] systematize the brand new association ranging from competition and you may chance inside our economic markets that’s nevertheless with us today. She named towards the FHLBs additionally the broader houses financing program so you’re able to focus on decreasing the racial difference in the homeownership. In the second quarter out-of 2022, this new homeownership rates for light domiciles is 75%, compared to forty five% for Black colored houses, with regards to the Agencies out of Treasury. On nearly 30 products, the latest racial homeownership gap try highest now than just it actually was in the 1960. She cited quick mortgage loans (under $150,000) and you may special purpose credit applications as the designs are advertised.

Ms. Rice recommended committed, perhaps not incremental, changes to your FHLBs when you’re Kathryn Legal, Harvey J. Goldschmid Teacher off Legislation and vice-dean at Columbia Laws College or university, entitled which a keen pleasing time to own rethinking this new role of your own FHLBs.

Panelists raised your situation out-of Silvergate Lender, a financial one to generally helps cryptocurrency stars and therefore lent heavily regarding the brand new FHLB program, particularly in recent times out-of worry, by way of example of how FHLB human body’s appeal has strayed from houses. The latest discussion highlighted the FHLBs focus on the type of and you will top-notch guarantee because of their enhances rather than the mission to own that the finance companies use men and women improves.

Men and women enhances generate profits plus the FHLBs have traditionally become necessary to expend a percentage of its payouts to your sensible houses by way of the newest Sensible Homes System (AHP) they provide. Luis Cortes, maker and you can Ceo away from Esperanza and a former person in brand new FHLBank from Pittsburgh’s panel out-of administrators, mentioned that FHLB conditions dont wade much adequate, proclaiming that the present day rates out of 10% regarding winnings getting AHP total bringing gamed because of the registration, because of the really worth the new FHLBs provide to their professionals. He troubled your role off regulators isnt accepted and one to a collaboration is in order. George Collins, former master exposure manager towards FHLBank of Boston, arranged, mentioning an annual government subsidy out-of $5-$6 mil with the FHLBs progressing the responsibility away from progress onto user financial institutions. I must say i genuinely believe that it is regarding welfare of users in order to jump give here … just like the professionals score an abundance of take advantage of the domestic mortgage bank operating system.

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/logo-chuan.jpg)

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/thu-mua-phe-lieu.jpg)