If you are searching to find a property inside New york and you may worried about capital, USDA funds could just be the answer you are searching for https://www.clickcashadvance.com/loans/online-personal-loans-with-co-signer/. USDA finance within the New york is backed by the latest USDA and you will promote qualified homebuyers inside outlying and you can residential district components the chance so you can secure sensible financing no deposit.

USDA finance is actually a captivating window of opportunity for prospective property owners who are in need of to acquire a home instead an enormous very first monetary weight.

What is an effective USDA Loan?

An excellent USDA financing try an effective federally-recognized financial program that can help individuals and you can group in to shop for residential property within the outlying and suburban portion. Instead of a traditional otherwise low-QM mortgage, USDA financing provide unique pros tailored so you’re able to homebuyers inside qualifying countries.

Among the many great things about it mortgage is financing with little to no downpayment required, and come up with homeownership significantly more accessible for those with restricted deals. Likewise, USDA money tend to function aggressive interest levels and flexible borrowing requirements, which makes them an attractive selection for qualified individuals looking to achieve their homeownership specifications in outlying New york and you will beyond.

USDA finance arrive regarding condition out-of New york, very residents trying to find USDA home loans within the Charlotte, NC, have the same possibilities while the men and women selecting capital within the shorter rural towns and cities such as Boone otherwise Asheville, according to the property you should purchase and its location.

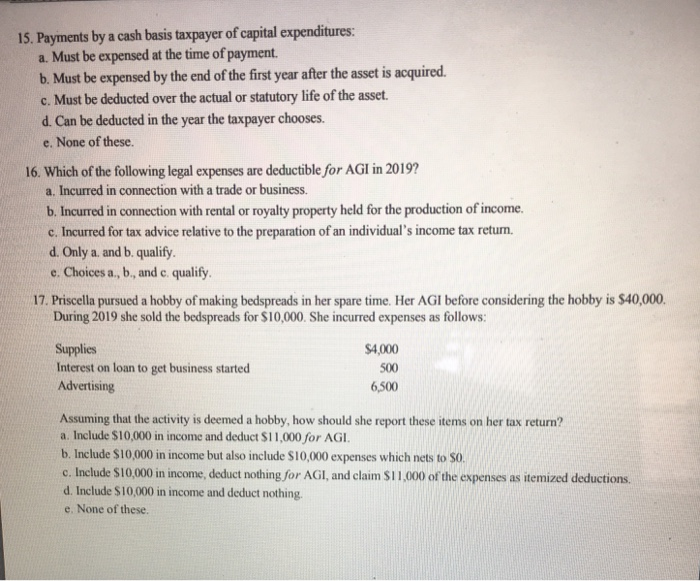

USDA Financing Standards in NC

To help you be eligible for a good USDA financing inside the NC, you’ll need to meet one or two categories of standards – new lender’s as well as the USDA’s. This type of money are not only about your economic status; they hinge into the property’s location and just how you want to put it to use. Some key USDA mortgage conditions in the NC are:

- Property location: The home you wish to get that have a beneficial USDA mortgage need be in a great USDA-designated rural town. These types of areas are generally outside major cities and are understood centered on people density.

- Income restrictions: USDA financing have money limits according to research by the area’s average money. All your family members income need to slide during these restrictions to help you be eligible for a great USDA financing within the NC. These types of restrictions vary according to the amount of people in your domestic additionally the county the place you want to find the assets.

- Number 1 residence: While using a USDA loan purchasing a home, you to definitely domestic must act as the majority of your household. Shortly after closure the loan, you need to certify which you are able to live-in the house as your prie.

The brand new USDA establishes money limitations to ensure the mortgage system remains available to some one and you may family which really you want financial help to order a house into the outlying elements. The latest USDA set general income limits in accordance with the number of members of the household, having higher restrictions having large group. not, these types of constraints can vary regionally according to items like the area’s median income.

As an example, your children income don’t go beyond 115% of your own median income for your needs proportions in your community the place you decide to buy property. While you are you can find general money restrictions, the particular limit to suit your area can vary based on regional economic climates.

To choose the qualification, the new USDA evaluates your income using more data, provided individuals sourced elements of earnings and you will write-offs, to make it to the household’s adjusted income, that is next versus appropriate money restriction for your urban area.

Positives and negatives out of USDA Money from inside the NC

While USDA funds provide several gurus, they aren’t a great choice for all. Qualification requirements centered on both the borrower while the assets can maximum who’ll make use of these finance. At exactly the same time, just like the diminished a downpayment requirement is a significant advantage, you should consider other factors just before investing these types of mortgage. Let’s explore the pros and drawbacks off USDA finance inside NC:

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/logo-chuan.jpg)

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/thu-mua-phe-lieu.jpg)