If you’re looking to own a beneficial ?sixty,000 home loan, their monthly payments was highest or online payday loans Hawai lower according to attract pricing, this new put in addition to period of your home loan label, just like the seen below. Your payments would be subject to of a lot activities, therefore, the table less than should simply be made use of just like the techniques. You could potentially estimate their harsh monthly premiums, considering other appeal and payment terms, using all of our desk less than.

This type of data would be to just be treated as the a guide rather than financial suggestions. Rates are derived from a repayment financial, perhaps not an appeal merely financial and calculated having Currency Recommendations Service’s financial calculator.

Lenders essentially render mortgages to those who will give a minimum deposit regarding 10%. Although not, particular loan providers encourage in initial deposit as little as 5%, equating to help you ?step 3,000, although some will get like a great fifteen% deposit, totaling ?9,000. The higher their put, the lower the loan-to-Well worth proportion that could release even more financial price solutions.

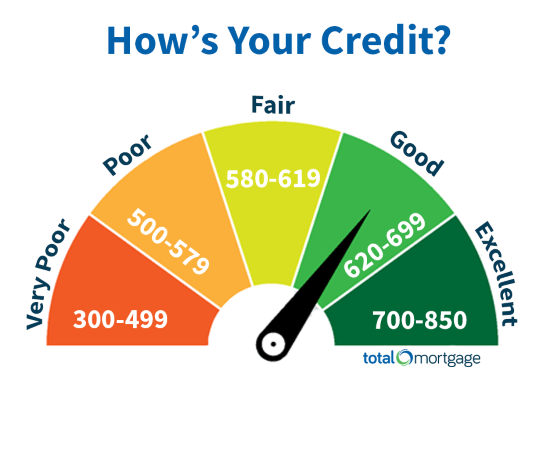

Many other points often affect your qualification to have a mortgage, as well as your credit history or a position background, so make sure you capture these types of under consideration when you talk towards the financial adviser.

If the selected home loan company explores their ?60,000 financial software, the company will at a few different factors, such as the initially deposit. Such, you need to estimate your own monthly income, be the cause of any normal outgoings which you have and you will examine it towards the monthly payments, bearing in mind financial terms and you can rates. The availability of a mortgage also can rely on your borrowing from the bank records. For those who have most other a fantastic borrowing, such handmade cards, shop cards, financing, automobile renting, or a history of later payments otherwise expense you may be given reduced options for the financial bargain.

If you need a better idea of brand new monthly payments to own the situation and an effective ?60,000 financial, was all of our home loan calculator and you can deposit calculator.

Specific loan providers can be reluctant to give home financing to the people that happen to be notice-functioning. For the reason that paycheck is among the most significant determiners to own the eligibility. Whenever you are notice-operating and should not demonstrate that you secure enough annually to pay for your instalments, you can battle.

Thank goodness, it isn’t impossible. You’ll need to show off your lender ranging from one 36 months away from account to prove you have sufficient finances and income of your business and you may demonstrate what you can do in order to create the brand new put. If you’ve delivered your self-Analysis income tax come back to HMRC for the past cuatro decades Tax Overviews or a good SA302 will be adequate. You may also suggest to them really works details, like details of next methods or hired account.

Fortunately, an effective ?60,000 mortgage was a comparatively touch to help you use, so you might not need to show off your company is and make huge payouts, just in case your company positions efficiently year round and you can year towards the seasons profits is actually stable, or growing.

Wages are one of the biggest deciders getting lenders. Generally, loan providers are willing to provide about three or maybe more times the household’s yearly income, often as much as five, but this is less if you have other a good bills and you can dependents. However, it will always be advisable to lay out increased deposit, including on a decreased credit matter instance ?60,000. This may boost your Loan-to-Worth proportion and may even leave you even more choices and versatile mortgage sales. Advisers within Home loan Information Agency can also be make suggestions on the right equipment for your month-to-month income.

Of many buy-to-help mortgage loans is attract-just, and you may come with their particular specific terminology. Particularly, you might have to currently individual a special property, and you should be prepared to spend a twenty-five% deposit. Thus, when you can apply for this form of financial at ?60,000, there could be a lot more will cost you regarding brief-name, plus offered-title highest rates of interest.

A destination-just home loan need one pay-off the worth of their loan given that label interesting repayments has come to an avoid. Along side term of financial, you simply pay the eye of one’s financing. No investment was paid off if you do not build more than costs. You may be required to pay off the bill with the expiration of your own title.

Of several purchase-to-help mortgage loans is actually focus-merely, so you might manage to play with any spared earnings off book payments to cover which latest contribution.

To find the right package Home loan Recommendations Bureau will appear at mortgages away from more 90 loan providers such as for example Barclays, Santander, NatWest, All over the country Building Society, Halifax and much more. Consult a visit right back in one of their pro advisors or see your nearest building neighborhood part observe exacltly what the selection are.

I continuously send out updates which have device recommendations, suggestions about enhancing your finances and you may most useful resources. If you prefer for which delight join our publication, which you are able to unsubscribe off at any point.

Home loan Recommendations Agency are right here to help you select the right deals to suit your ?60,000 financial. Their advisors will look out of a share more than ninety certified lenders to help you secure the proper deal for your house. Respond to particular home loan related inquiries and you will an adviser will provide you with a call to talk about the options. Or you can visit your nearest strengthening neighborhood part.

Repayments on a ?30,000 mortgage

Payments will be swayed greatly by-interest rates and you may deposit number therefore we’ve resolved the many costs away from an effective ?30,000 home loan for your requirements.

Payments towards the an effective ?50,000 home loan

?50,000 is significantly of money however the month-to-month payments get perhaps not see you to definitely crappy, particularly if you can save having a more impressive put. Find out about the purchase price right here.

Mortgage loans for more than 50s

Bringing a mortgage when you’re more than fifty really should not be difficulty. Information about how to find another type of mortgage whether or not you desire to move household otherwise remortgage your home. A twenty-five seasons financial at the 50 might not be off of the notes!

Here ount you only pay all depends abreast of your circumstances. The cost is up to 1.00% but a consistent percentage was 0.30% of the amount borrowed.

Nottingham Building Society are an introducer so you’re able to Mortgage Information Agency to own financial guidance and you will coverage. Financial Information Bureau are an investments label away from Brook Monetary Characteristics Restricted which is an appointed member out-of Home loan Suggestions Agency Restricted and you will Financial Guidance Agency (Derby) Limited which are authorised and you may regulated by Financial Make Expert (FRN 529047). Brook Financial Features Minimal. Joined Office: The old Courthouse, 60a London area Roadway, Grantham, Lincolnshire, NG31 6HR. Inserted for the England Amount: 07311674.

There is absolutely no make sure that you will be able to set up proceeded permitting of the home, nor you to leasing money might possibly be sufficient to meet up with the cost of your own mortgage.

Nottingham Strengthening Neighborhood, Nottingham Family, step 3 Fulforth Road, Nottingham, NG1 3DL, is actually authorised by Prudential Regulation Power and you may controlled from the Economic Make Power additionally the Prudential Regulation Power; Economic Services Subscription No. 200785.

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/logo-chuan.jpg)

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/thu-mua-phe-lieu.jpg)