- Throughout the FHA Loans

- Requirements

- Pricing

- How to Incorporate

- Framework Money

- Condo Approval

- Are built Mobile

- Energy efficient Home loan

- FHA 203K Money

FHA funds enable it to be borrowers purchasing a home with no need having a giant advance payment or a leading credit rating.

These types of loans are backed by the new Federal Property Management, a company that actually works under the Agency off Casing and you will Urban Development. From the FHA make sure, loan providers which situation this type of resource was secure for many who standard on your financing. This is why, they can be more lenient towards standards to try to get a mortgage.

This will make FHA financing a greatest option for first-day customers and those whose borrowing otherwise money ensure it is hard so you can qualify for a normal financial.

Step 1: Browse FHA Loan Conditions

Just before dive into the application, it is essential to know if you will be a good candidate having an FHA mortgage. FHA finance possess certain standards, plus credit ratings, off repayments and financial obligation-to-income rates.

Fundamentally, you will want a credit rating out of 580 or higher to have good 3.5% down-payment. When your get are between 500 and 579, you might still meet the requirements, but you will you need a beneficial ten% down payment. Learning these standards very early enable you to discover when the an enthusiastic FHA financing suits your position.

2: Contact FHA-Acknowledged Loan providers

Not all bank even offers FHA fund, so you will have to choose one that does. Find FHA-accepted loan providers in your area to make very first contact. More banking institutions and you will financial people offer this type of financing, that it shouldn’t be rocket science discover a being qualified lender.

This action makes you ask questions, see particular software techniques, and commence building a love with each lender. Various other loan providers you’ll bring quite some other prices and terminology, therefore please shop around.

Step 3: Assemble Expected Files

Once you have chose a lender, initiate event the necessary files to suit your software. So it normally comes with evidence of earnings, a position records, personal identification, and information on any expenses and you will possessions.

Which have such records in a position increases the method and shows your own seriousness and you may organization on the bank. Versus that it papers, the lender do not proceed along with your app, therefore that have they prepared decrease possible waits.

Step four: Complete FHA Application for the loan

The next thing along the way is to try to over good Consistent Home-based Application for the loan, labeled as the fresh Federal national mortgage association Mode 1003, to try to get an enthusiastic FHA financing.

Contained in this form, you must deliver the property address and kind from loan paydayloansconnecticut.com/saybrook-manor your require, also information regarding recurring expenses, money supplies, money wide variety, construction costs, and you will early in the day/newest employment. One which just fill out the job, you will consent to a credit assessment, so that your bank is glance at debt record.

To date, you can even need to pay a charge for the loan software. Or even, it could be included in the closing costs. This may differ round the lenders, so be sure to consider their rules.

Action 5: Examine Loan Prices

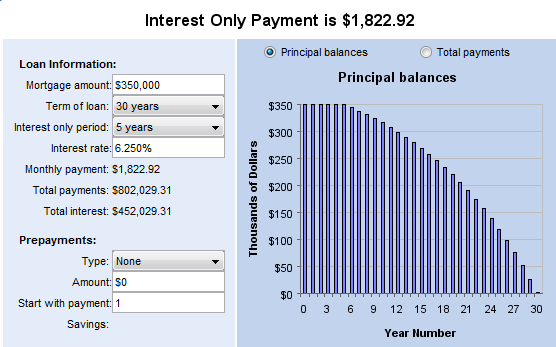

Shortly after implementing, loan providers offers that loan guess (LE). LEs are created to improve loan process transparent. It file traces the costs associated with the your loan, including the interest rate, monthly premiums, and you may closing costs.

You’ll get mortgage prices away from for every bank you applied which have, giving you the opportunity to contrast and get an educated price. Think of, a low rate is not constantly the top if discover somewhat highest costs.

The way to get Your FHA Application for the loan Acknowledged

Having your FHA application for the loan accepted ‘s the 2nd large action immediately after implementing. Approval mode you may be a stride closer to managing your perfect household.

Just how long will it decide to try submit an application for a keen FHA loan?

The full time it will take to try to get an FHA financing can be differ somewhat considering numerous products, for instance the difficulty of the financial situation, the brand new completeness of one’s application, plus lender’s control timesmunicate on a regular basis together with your financial and you can respond quickly to virtually any requests suggestions otherwise papers to ensure a good smoother, smaller processes.

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/logo-chuan.jpg)

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/thu-mua-phe-lieu.jpg)