For many of us, especially very first-big date homeowners, our home loan techniques can seem to be somewhat challenging when searching within the about additional. You may be thinking, Exactly what suggestions have a tendency to the lender you desire? How can we know the way far family we can afford? How can we also begin? A few of these issues are very well-known and should getting treated very early on in the home financing processes. In terms of how to begin, the very first action should you be looking to buy property is to obtain pre-approved together with your lender.

Within the pre-approval techniques, your loan officer have a tendency to ask you to complete an internet financial app. At exactly the same time, the loan officer often request you to bring employment history, economic recommendations instance bank comments and you can paystubs, plus desired down payment amount. This article would-be always dictate your debt-to-money proportion, and mortgage applications and you may rates that can be offered for your requirements.

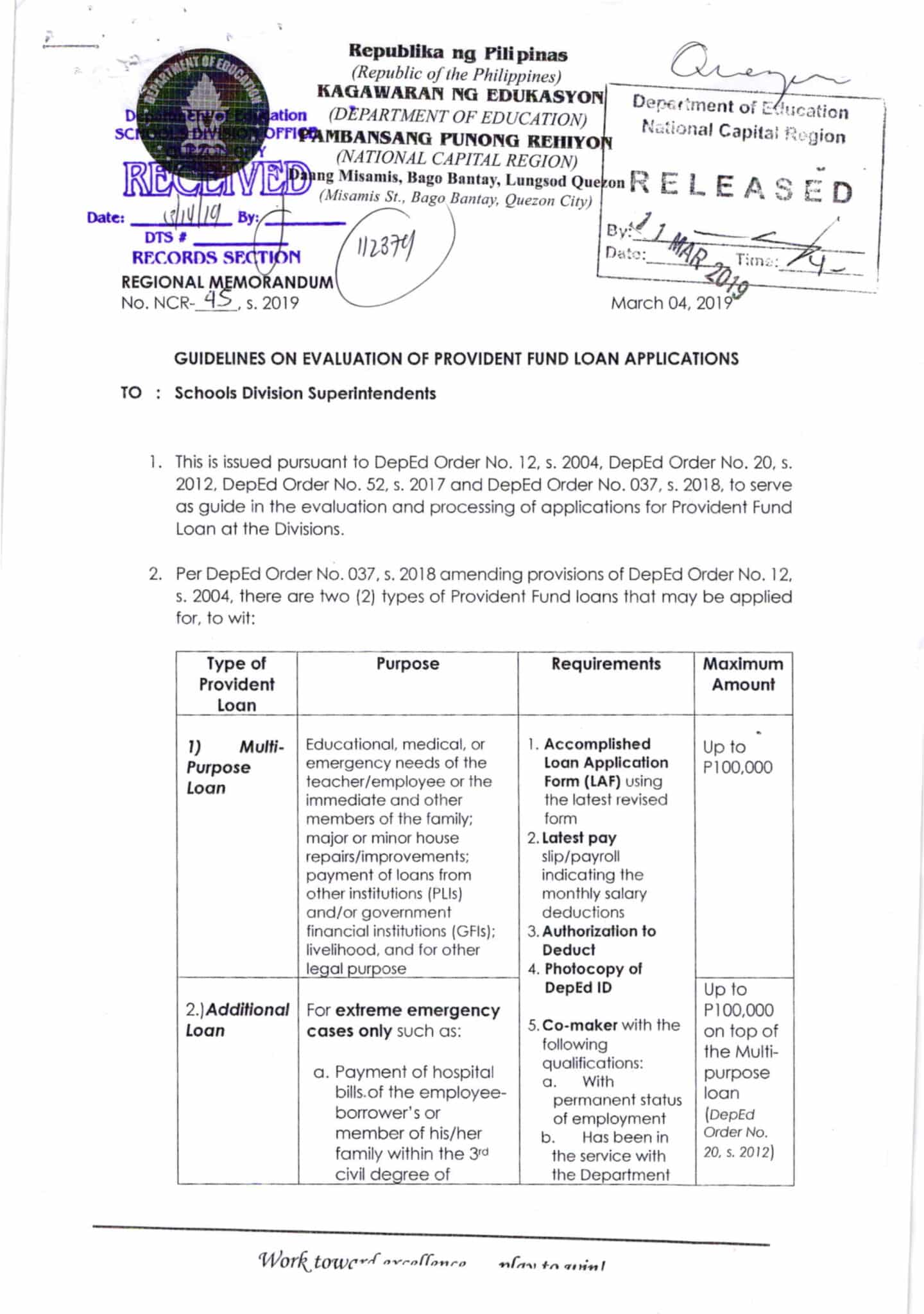

And all matter crunching, your loan officer will explain the concepts of the house financial support processes and place correct requirement and you will timelines. You ought to discover a great pre-approval letter contained in this a few working days, including additional info regarding your second tips.

Exactly what happens if you don’t get pre-recognized for a loan according to no less than one factors? Usually do not fret, it doesn’t mean you have got to give up your home financing needs. You’ll be able to only have to proper any problem components since the conveyed by your financing officer.

Listed below are widely known explanations a borrower isn’t pre-accepted right away together with all about how to right the newest inadequacies to set up having after you re-apply after.

Borrowing Points

Just like any sort of mortgage, the lender wants to make certain you try a fair business risk, this is the reason a glance at your credit score and you will credit record is an important part of your pre-acceptance study. A low credit history can be the result of multiple products, along with late charge card money, the previous beginning off numerous credit accounts, otherwise an exceedingly large debt harmony. You could potentially replace your credit photo to aid make sure a profitable coming pre-recognition by:

- Examining having credit card issuers if you think specific late commission notifications is actually wrong.

- And also make financing and you will charge card repayments timely.

- Decreasing the harmony of one’s overall outstanding loans, along with rotating bank card account.

- Perhaps not trying to get the brand new playing cards.

- Stop canceling vacant credit account. Any loans which you have reduced promptly was a confident to remain your general credit score.

West Virginia. installment loan

You should also avoid quick fix credit repair scams. If you feel additional support is necessary, it might be wise to contact a reputable credit counselor for advice. Your loan officer may have a referral for you.

If you prefer a research sheet to store helpful otherwise hang for the fridge since a note, download all of our Credit Do’s and you will Don’ts flyer here.

Debt-to-Money Proportion

The debt-to-money ratio (DTI) is actually a significant element of good borrower’s full borrowing from the bank studies. The DTI compares your own monthly personal debt fee towards month-to-month terrible earnings. A particularly higher proportion is an issue whilst mode you could have problem using your own monthly credit card bills, with your monthly mortgage repayment. A diminished proportion demonstrates that youre effective at managing their finances and higher able to meet most of the bills on time.

You to simple solution to a high DTI is always to reduce a lot more of your own repeating credit balance, therefore reducing the proportion.

Of course, a rise in month-to-month income away from a marketing and other provider could also be helpful eliminate an excessively highest DTI, although this is harder to find easily.

A job Background

The capability to pay-off your loan mostly hinges on the month-to-month earnings, so stable work background was an initial thought getting pre-acceptance. An irregular a job checklist would-be one other reason for perhaps not being qualified.

A standard tip is that you must be employed for within the very least 2 yrs, however necessarily with the same workplace. Providing a wages stub demonstrating seasons-to-day money including W-dos models coating a couple of years out of a career was proof the work number.

You are capable show exactly how extenuating circumstances authored a great short-term a position pit. If you don’t, the obvious solution to alleviate a serious deficiency would be to remain employment on wished some time up coming reapply to suit your mortgage.

Bucks Reserves

Being unable to result in the down-payment needed for their new home will be a poor cause for your pre-recognition.

For people who use up all your that it cash set aside, you can remain preserving then re-apply after you have conserved the brand new needed advance payment amount or think advance payment direction alternatives.

Rather option, you happen to be able to use current money into the the down payment. The loan manager is also feedback any related current currency assistance that have you if you wade it channel.

It’s important to just remember that , not receiving pre-accepted to possess a mortgage is frequently just a short-term end on your road to homeownership. It might take a little longer to uncover your goal, you could succeed which have determination and extra effort. All of our OneTrust Mortgage brokers loan officers are committed to dealing with one to result in the financial feel given that efficient and problem-totally free an experience that one can. When you’re willing to start looking for your residence financing desires, get started now.

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/logo-chuan.jpg)

![Thu Mua Phế Liệu Hà Nội Giá Cao [UY TÍN] Hỗ trợ 24/24](https://thumuaphelieuhanoi.com/wp-content/uploads/2021/07/thu-mua-phe-lieu.jpg)